Understanding the Factors That Affect Your Credit Score

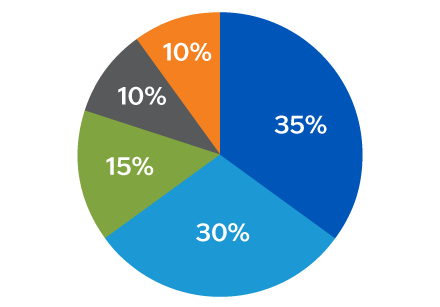

Building or rebuilding your credit is possible, and it starts with understanding the factors that play a role in shaping your score. Your credit score is influenced by various factors. Here’s a quick checklist to help you understand what may be impacting your score:

- Payment History (35%): Late payments, defaults, and bankruptcies can hurt your score. Always strive to pay your bills on time.

- Credit Utilization (30%): This is the ratio of your current credit card balances to their limits. Keeping your utilization below 30% is recommended.

- Length of Credit History (15%): The longer your accounts have been open, the better it is for your score. Avoid closing old accounts.

- Types of Credit (10%): A mix of credit types (credit cards, mortgages, installment loans) can positively influence your score.

- New Credit Inquiries (10%): Each time you apply for credit, it results in a hard inquiry. Too many in a short period can lower your score

Building Your Credit Starts Here

Credit Matters Loan

Build your credit step-by-step with our simple loan terms and manageable payments. All members qualify, regardless of their credit score.

- Loan amounts range from $600 to $1,500, with a repayment term of 12 months.

- Loan proceeds are placed in a restricted savings account and are released after the loan is paid in full.

- Successful monthly repayment is reported to credit bureaus, which can have a positive impact on your credit score.

- Automatic drafts can be set up to pay this on time, every time.

Secure Credit Card

Unlock better credit opportunities with our Secure Credit Card—safe, simple, and designed to help you grow.

- Fixed Monthly Rate: 1.99% APR*

- Monthly Participation Fee: $10 applied to the card balance

- No Minimum Balance Required ($500 minimum encouraged).

- Credit Monitoring Made Easy: Track your progress through our Credit Score Tool accessed through Digital Banking.

Credit Builder Tools & Resources

Credit Score Tool

Master your credit with our FREE and easy-to-use credit monitoring tool.

- Free Credit Score Updates

- Credit Alerts to keep you on track

- Tips to improve your credit score

- Personalized offers and financial guidance

Guardian Financial Literacy

Take control of your financial future—learn credit-building strategies with our free educational tools. Guardian has partnered with Banzai to bring you interactive modules on budgeting, credit management, and debt reduction— all at no cost.

With age-appropriate learning components, these resources are designed for all age groups, ensuring that everyone can benefit, regardless of their stage in life.

Certified Credit Counselors (CCCs)

You’re not alone on your credit journey—Guardian's Certified Credit Counselors are here to help every step of the way. Our team of experts understands the complexities of credit management and is dedicated to helping you achieve your financial goals.