Get Savvy About Your Credit

Access and Monitor Your Credit

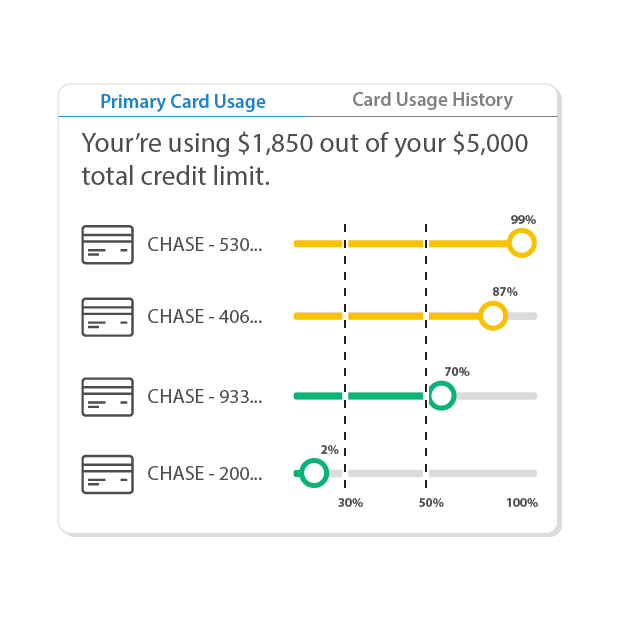

Access your full credit report to view important details like your payment history, credit usage, different lines of credit, and other key factors that impact your score.

Monitor your credit report for unusual activity or errors, ensuring you're always alerted to potential issues and can stay on top of your financial health.

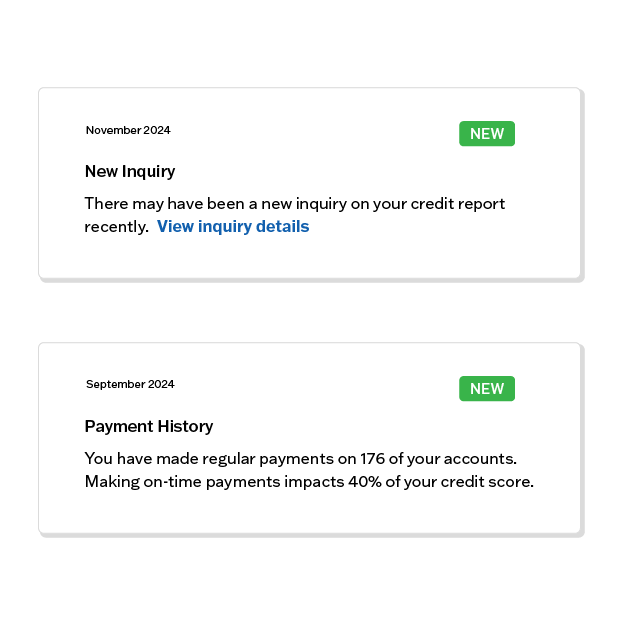

Credit Alerts and Protection

Stay informed with real-time credit alerts for changes in your credit score, new inquiries, and updates to your payment history, helping you protect against fraud and identity theft.

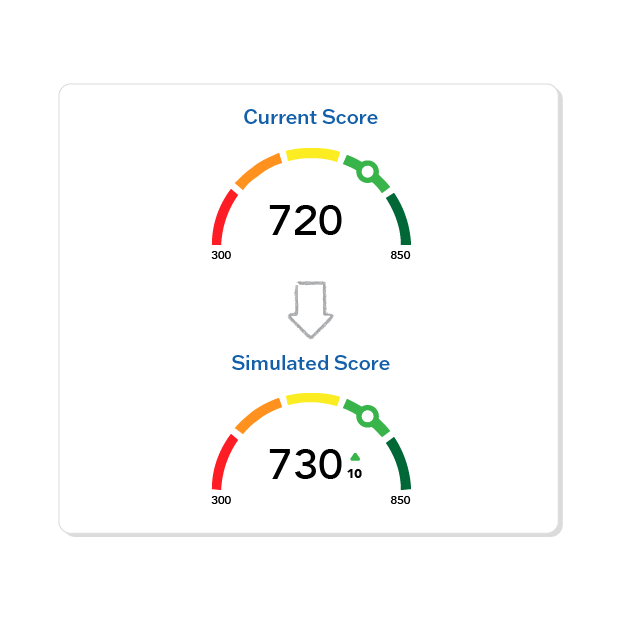

Credit Improvement Features

Set and achieve your credit score goals with personalized recommendations and progress tracking tools. Using the credit score simulator allows you to explore how different financial decisions impact your score.

Financial Tips and Personalized Offers

Guardian's Credit Score Tool provides personalized tips to help improve your credit health and stay on track for your financial goals. Also, you'll receive customized offers tailored to your unique credit profile, including recommendations for loans, credit cards, and other financial products that align with your needs and goals.

How to Enroll in the Credit Score Tool

Log into Online Banking

- Hover over 'Financial Tools' in the top toolbar and select 'Credit Score Tool.'

- Read and accept the disclosure to retrieve your Credit Score.

- This is a soft pull and will not affect your score.

- Explore the feature highlights in the pop-up dialog or skip ahead to continue your credit monitoring journey.

Log into Mobile Banking

- First, log in to your mobile banking app. Tap the three dots in the bottom right corner, then select 'Financial Tools' and choose 'Credit Score Tool.'

- Scroll down and tap 'Get Started.'

- Read and accept the disclosure to retrieve your Credit Score.

- Explore the feature highlights in the pop-up dialog or skip ahead to continue your credit monitoring journey.

Got Questions? We've Got Answers.

Is there a fee?

No. It's entirely free, and no credit card information is required to register.

How often does my credit score get updated?

If you regularly access digital banking, your credit score will be updated every 7 days and displayed within digital banking.

You can also refresh your credit score and full report every 24 hours by clicking “Refresh Score” and navigating to the detailed Credit Score Tool Dashboard within digital banking.

What if the information provided by SavvyMoney appears to be inaccurate?

Each credit bureau has its process for correcting inaccurate information, but every user can "File a Dispute" by clicking on the "Dispute" link within the SavvyMoney credit report.

Will enrolling or accessing the Credit Score Tool 'ping' my credit and potentially lower my credit score?

No. Checking your credit score through the Credit Score Tool is a "soft pull" which does not affect your credit score.

Do I need Online Banking to use the Credit Score Tool?

Yes, the Credit Score Tool is only available to members who are enrolled in Online or Mobile Banking.

Don’t have Online Banking? Enroll now to get started and access your free credit score updates, alerts, and more.