Financial Literacy

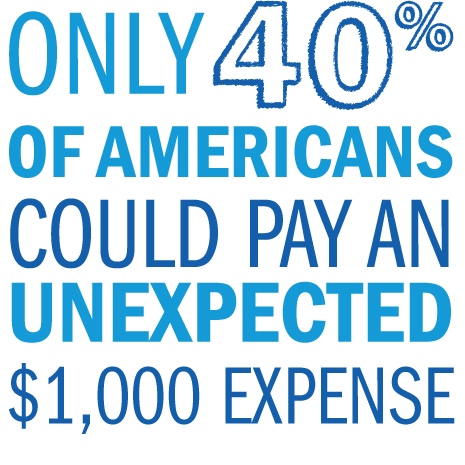

Financial wellness starts with knowledge. That’s why we have partnered with Banzai to provide free, real-world financial education designed to help you and our entire community make confident, informed decisions at every stage of life.